The once-thriving and revered heart of the tech world, Silicon Valley, is now facing an unprecedented collapse. While the ramifications are widespread, this downfall has opened up new possibilities for the thriving cryptocurrency market. In this blog, we will delve into the reasons behind Silicon Valley’s collapse and discuss the potential consequences for the crypto ecosystem. So, buckle up and join us on this journey to explore a new era in the world of technology, and gain a deeper understanding of how this shift could possibly reshape the world of digital currency.

The downfall of Silicon Valley:

The recent collapses of some of the world’s most prominent tech giants located in Silicon Valley, has had a ripple effect throughout the crypto markets. Investors and analysts alike have felt a mix of emotions as their portfolios take hits that no one saw coming. It’s certainly understandable why this news has jarred the markets so badly; many investors have been pouring time, energy and resources into tech stocks, now there is uncertainty over how to best approach investing in the future. These events serve as an important reminder that risk carries rewards, but responsible investing means having measures in place to mitigate losses if such downturns occur. The direction cryptocurrency will take in the wake of these collapses is yet to be seen but its sure to be interesting.

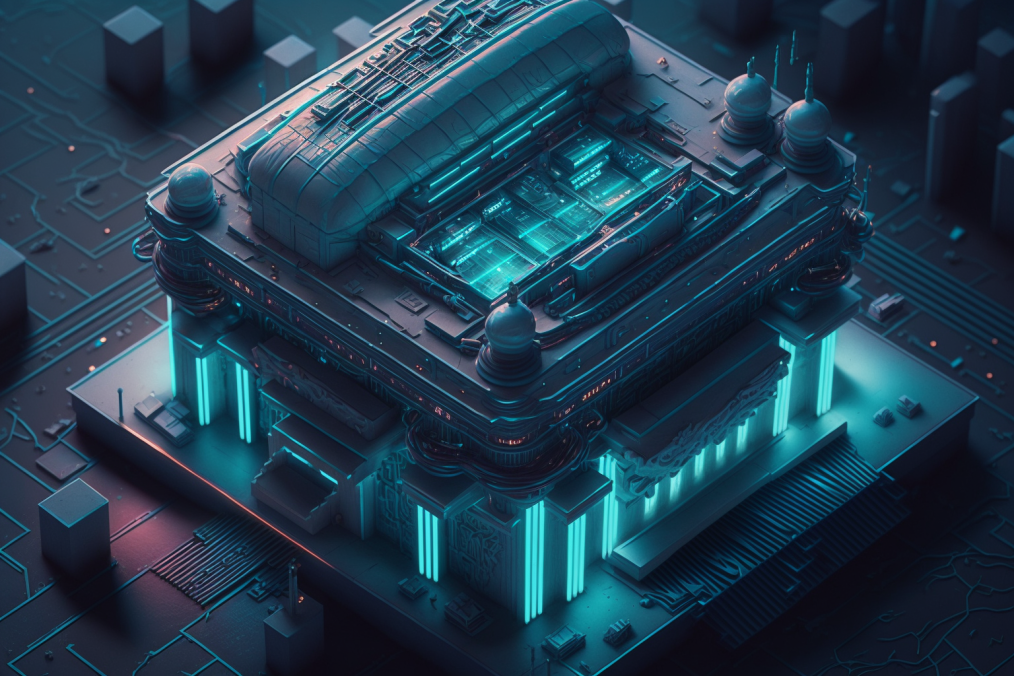

Silicon Valley, once the epicenter of technological innovation, has been slowly losing its charm. High living costs, competitive job markets, remote work culture, and the growing influence of other tech hubs are some of the factors contributing to this decline. But the question persists – what does this mean for the crypto market? The loss of Silicon Valley’s monopoly on tech-driven industries has created a more decentralized landscape, allowing new regions to emerge as technology hotspots. This can be seen as a positive change for the promotion of cryptocurrencies, since decentralization has always been a key aspect of the crypto ethos.

Cryptocurrency and blockchain technology gain momentum:

As Silicon Valley fades into the background, cryptocurrency and blockchain technology are on the rise. The past few years have seen a growing interest in these technologies, with their potential to bring transformative changes to various industries. The ambitious nature of cryptocurrency and blockchain projects replicates Silicon Valley’s golden era of innovation, but this time, it’s on a global scale. With numerous countries and cities emerging as crypto and blockchain hubs, the landscape is truly changing.

The recent collapse of the Silicon Valley tech bubble has been felt far and wide, with reverberations felt in the world of crypto. Crypto startups located in this region were hit especially hard, given how much of their capital was tied up in unit economics and cash flow models that relied heavily on continuity in investor enthusiasm. This reduced access to resources has caused most of these startups to suffer — some have ceased operations altogether — as they try to recover and get back on track. The drop-off in active Silicon Valley projects could mean a shakeup in the world of crypto, potentially reducing investments into projects related to cryptocurrencies while also curbing innovations into blockchain-based products. If this trend persists, those seeking an edge should look outside of the valley for opportunities within crypto markets.

New tech hubs foster crypto innovation:

While headquarters of major tech companies were once concentrated in Silicon Valley, the decentralization of tech hubs across the world is presenting an exciting opportunity for the crypto market to spread its wings. Cities like Miami, Berlin, London, and Singapore are becoming hotspots for crypto innovation, with each offering an ecosystem conducive to the growth of cryptocurrencies and their underlying technology. There is no doubt that the rise of these tech hubs and developer communities is playing an important role in the mainstream adoption of cryptocurrencies.

Regulation and policies:

The collapse of Silicon Valley has led to an increased need for regulatory frameworks governing cryptocurrencies. Country-specific regulations are emerging to govern the usage of these digital assets and eliminate fraud or illegitimate practices. A decentralized approach to technology innovation means that nation-specific policies play a crucial role in shaping the global crypto landscape. This element of universal participation democratizes the tech landscape, allowing different countries to influence and nurture the growth of cryptocurrencies.

Crypto startups and investments:

With increased interest in crypto innovation and blockchain technologies, venture capitalists and investors are looking to harness the potential of these digital assets. Once heavily dependent on Silicon Valley, the investment market has globalized, giving a much-needed boost to the growing number of crypto startups across the world. As more investors put their money into cryptocurrencies and blockchain projects, these startups continue to gain momentum, paving the way for a more robust and diverse crypto ecosystem.

Conclusion:

The collapse of Silicon Valley presents a unique opportunity for the crypto market to step into the limelight, bringing with it a wave of innovation and growth. Decentralization is the key takeaway from this paradigm shift, as it mirrors the core ethos of cryptocurrencies. As we witness the rise of new technology hubs, more favorable regulatory frameworks, and increased investments in crypto startups, the crypto industry is likely to experience significant growth in the coming years. While the ongoing transformation comes with its fair share of challenges, it also serves as a testament to the resilience of the cryptocurrency market and the boundless potential it holds for the future.